It can be unsettling when the news cycle buzzes with fresh stories of market upheaval. Maybe you’ve noticed an uptick in fear-driven headlines, or you’ve witnessed your social media feed become a flurry of speculation. When so much chatter focuses on uncertainty, it’s only natural to question whether it’s time to batten down the financial hatches.

The reality is that markets have always ebbed and flowed. While market history rarely repeats itself exactly, it often rhymes—meaning we can look to past volatility for lessons on what might help insulate your portfolio. Below, you’ll find a list of five investment vehicles often used to hedge against stock market swings, followed by a look at cryptocurrencies and a quick case study about how a major investment firm, BlackRock, is shifting its holdings.

1st Place: Bonds

Bonds are essentially IOUs issued by governments, municipalities, or corporations to secure funding. Purchasing a bond is essentially extending credit to the entity offering it. In return, you receive periodic interest payments, and once the bond reaches its due date, your initial investment is reimbursed in full. Though often overshadowed by stocks in media coverage, bonds have long been a cornerstone of portfolios aimed at stability.

Below are some key factors to consider when thinking about bonds as a hedge against market volatility:

Steady Income Potential: Bonds typically provide fixed interest payments on a scheduled basis. This predictable income stream can act as a buffer against market fluctuations, helping smooth out the rollercoaster ride that often comes with stocks.

Rate Environment Considerations: In periods of rising interest rates, newer bonds can offer higher yields. If you lock in bonds when rates are elevated, you could benefit more than simply parking your cash in a high-yield savings account. However, be aware that if interest rates climb after you purchase an older, lower-yielding bond, its market price may drop (though you’ll still receive the stated interest rate if you hold to maturity).

Credit Quality and Duration: Not all bonds carry the same risk. U.S. Treasury bonds, for example, are generally considered the safest in terms of credit risk, whereas corporate bonds vary depending on the issuing company’s financial health. Duration (i.e., the bond’s sensitivity to interest rate changes) also matters: longer-duration bonds are more volatile in response to rate shifts, while shorter-duration bonds tend to be less sensitive but offer lower yields.

2nd Place: Cash

When financial professionals talk about “cash,” they usually mean any highly liquid, low-risk place to park money—like a savings account, money market account, or even a short-term certificate of deposit (CD). This portion of your portfolio is meant to be readily accessible for emergencies or near-term goals.

Here are some ways cash can help protect you in turbulent markets:

Immediate Liquidity: One of the biggest advantages of holding cash is that you can tap it at a moment’s notice. If you need funds for unexpected expenses or want to capitalize on a sudden market dip, having liquid reserves can be a strategic lifeline.

Emergency Buffer: Markets can experience sudden downturns, but life keeps rolling along. Having enough cash on hand provides peace of mind and can prevent you from having to sell assets at depressed prices just to cover urgent bills. This is especially important if your income or employment situation changes during a market slump.

Opportunity Cost and Inflation Risk: While holding cash can feel safe, it’s not entirely risk-free. Inflation gradually eats away at your purchasing power. Although high-yield savings accounts and money market funds offer some protection through interest rates (often influenced by Federal Reserve policies), they typically won’t keep pace with long-term inflation. So, cash is best viewed as short-term protection rather than a long-term growth strategy.

3rd Place: Buffered ETFs

Buffered exchange-traded funds (ETFs) are specialized investment products designed to limit downside exposure while still allowing for some upside potential. They generally use options strategies to “cushion” market drops, though they often cap gains as well.

Here are some points to consider when evaluating buffered ETFs for stability:

Downside Cushion: Buffered ETFs usually protect against a certain percentage of losses. For instance, a product might shelter you from the first 10% of a market decline over a set period. If the market falls 8%, your buffer shields you. If the market tumbles 12%, you’ll be exposed to the 2% that exceeds the buffer.

Participation Caps: The trade-off for this buffer is a limit on future potential gains. If the market surges beyond a predetermined level, the ETF’s structure prevents you from reaping all those extra profits. This might be a fair deal if your main priority is limiting losses rather than maximizing every possible upswing.

Complexity and Costs: Buffered ETFs can be more complex than plain-vanilla funds, often employing intricate options strategies. This can lead to higher expense ratios. Additionally, understanding exactly how each product’s buffer is calculated and how its cap is set is imperative before diving in, since not all buffered ETFs follow the same blueprint.

4th Place: “Safer” Stocks

No stock is 100% safe, but some companies are generally less volatile due to stable earnings, strong balance sheets, and proven business models. Often found in sectors like consumer staples, healthcare, and utilities, these stocks can provide relative stability during choppy markets.

Here are several elements to think about when considering “safer” stocks for your portfolio:

Stable Dividends: Many well-established companies in defensive sectors pay consistent dividends. These payouts can help offset market dips by providing a regular income stream. Dividends may not be guaranteed, but historically, companies with long track records of dividends have often weathered market downturns better than more speculative names.

Lower Beta: In stock market jargon, “beta” measures how volatile a stock is relative to the market. When a stock’s beta is 1, its price swings tend to follow the overall market’s ups and downs. Stocks with a beta less than 1 are considered less volatile. If preserving capital is a key concern, seeking lower-beta stocks could be a strategic move.

Long-Term Growth Potential: While utility or consumer staple stocks might not skyrocket as quickly as a hot tech startup, they can provide steady growth over time. This balance between gradual appreciation and reduced volatility can be attractive if your goal is to hedge against dramatic market swings while still aiming for some upside.

Please Note: Custom indexing can help you more precisely select and manage these types of stocks, tailoring your holdings to match your risk tolerance and market outlook. If you’d like to dive deeper into how custom indexing works—and learn about our approach—be sure to check out our dedicated post on this topic.

5th Place: Commodities

Commodities are raw materials or agricultural products—encompassing metals like gold and silver, energy sources such as oil and natural gas, and farming outputs like wheat or corn. Investing in commodities can involve purchasing the physical goods, futures contracts, or commodity-focused funds.

Below are some important considerations for commodities as part of a volatility hedge:

Diversification Benefits: Commodities often perform differently from stocks and bonds, so adding them to your portfolio can help reduce volatility. When equities are sinking, certain commodities may hold their value or even rise, offering a potential cushion.

Inflation Hedge: Over time, certain commodities—particularly valuable metals—have often provided a shield against the erosive effects of inflation. When the cost of living climbs, the prices of hard assets can increase in tandem, preserving or even growing your purchasing power. That said, not all commodities react uniformly to inflationary pressures.

Volatility and Timing: Commodity prices can swing dramatically based on geopolitical events, supply disruptions, or shifts in global demand. While these assets can offer diversification, they also require careful timing and a thorough understanding of the market dynamics that drive their value.

What About Cryptocurrencies?

Cryptocurrencies often grab headlines as an innovative frontier, sparking lively debates over whether they represent the next big thing or a speculative bubble waiting to burst. In reality, this asset class is still evolving, making it tricky to declare it a reliable haven.

Unlike gold, which has millennia of history as a store of value, cryptos are relatively young—many are just over a decade old. That short track record means there’s limited precedent for how these digital currencies behave in prolonged bear markets, global recessions, or times of intense geopolitical strife. Some of their extreme price volatility also makes them a less-than-ideal solution for those purely seeking stability.

If you’re drawn to the potential of digital assets, it’s often wise to approach them as a smaller slice of an overall portfolio, rather than a cornerstone of your volatility hedge. Keeping your crypto allocation modest can help you explore the space without jeopardizing the core of your long-term investment plan.

Real Example: Blackrock’s Recent Portfolio Reallocation

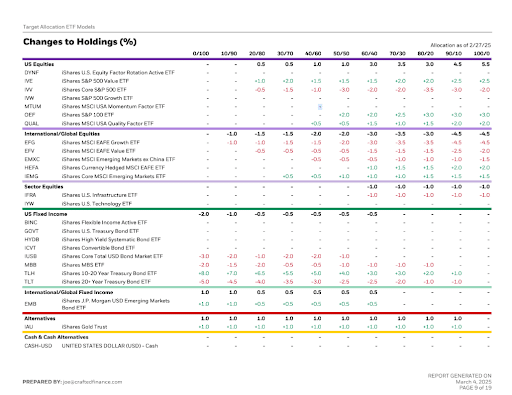

BlackRock, one of the world’s largest asset managers, recently adjusted its portfolio in response to heightened market uncertainty. A picture of the changes they made to one of their suites of ETF model portfolios can be seen below

You’ll notice shifts into:

More U.S. Equities and Factor-Based Strategies: BlackRock increased allocations to U.S. equity holdings, particularly shifting funds toward value (IVE) and large-cap quality (QUAL). In several model portfolios—especially those with higher equity allocations—core S&P 500 exposure (IVV) was trimmed, while positions in S&P 500 Value (IVE) and S&P 100 (OEF) grew.

Shorter-Duration Treasuries Over Longer-Term Bonds: When you look at the fixed-income adjustments, there’s a notable reduction in the 20+ Year Treasury Bond ETF (TLT) in favor of the 10-20 Year Treasury Bond ETF (TLH). In other words, BlackRock appears to be slightly shortening duration. Across the board, there’s a modest decrease in overall broad-based U.S. bond ETFs (like IUSB) as the firm rebalances toward more selective bond strategies.

A Recalibrated International Allocation: International and global equities took a haircut (particularly EFG, the EAFE Growth ETF), but BlackRock added a bit to emerging markets (IEMG) and currency-hedged developed markets (HEFA).

Increased Gold Exposure: Finally, you’ll see a consistent +1% allocation to gold (IAU) across various portfolio models. Gold often serves as a hedge against uncertainty.

In the same market report, Blackrock detailed several key reasons as being responsible for some of their changes. They also provide insights into their trade rationale as a whole.

Blackrock’s key takeaways include:

Trim equities overweight from 4% to 3%, maintaining a clear preference for stocks over bonds while recalibrating our risk-on stance

Increase overweight to U.S. over international developed market (“DM”) stocks, favoring large, high-quality U.S. companies with relative earnings strength while fading the recent DM rally as regional forward earnings guidance cools

Reduce the bet against Chinese equities, mitigating exposure to potential positive surprises from tariff negotiations and aggressive Chinese government stimulus

Add to scarce assets with another 1% to gold – funded from fixed income, as catalysts for global trade disruption and geopolitical conflict appear ripe

Shorten duration positioning within U.S. treasuries, expecting to capture similar term premiums and yields but with less volatility

Blackrock’s trade rationale explained at a high-level:

Markets shrugged off multiple “tape bombs” (hot inflation, a hawkish Fed, AI stock sell-off, and trade policy updates) yet still attracted “buy the dip” behavior—a testament to continued risk appetite amid episodic volatility.

We remain strategically overweight risk assets but are gradually reducing some exposure, anticipating that these sources of “market consternation” could trigger further turbulence.

Our macro growth outlook still supports an equity overweight, though it’s now more tempered, reflecting above-consensus forecasts that are increasingly priced in.

Corporate earnings impressed again but analyst expectations for 2025 have cooled, leaving the market more prone to potential disappointments as downgrade frequencies rise.

“Tariff” is the new boardroom buzzword, with mentions surpassing previous highs; while new tariffs may pinch margins, overly bearish sentiment suggests upside surprises could materialize.

We continue to favor U.S. over developed markets (DM) despite the narrative that U.S. tech is overcrowded and DM offers contrarian value. Under-the-hood data shows mega-cap tech under-owned, while DM stocks have become a consensus long idea.

Recent DM outperformance could stall as earning signals soften and geopolitical headwinds persist—particularly for Europe, which we view as lagging in AI infrastructure and facing complex regional challenges in 2025.

We Can Help You Hedge Against Volatility

Even when the headlines seem unrelentingly grim, it’s important to remember that volatility is nothing new. The market’s natural ups and downs are part of a bigger cycle, and while no one can predict the future with absolute certainty, preparing for bumps in the road has always been a prudent move.

With the right strategy, you can create a more resilient portfolio that aims to weather the storms without forfeiting all potential growth. Each of these options plays a different role, from providing immediate liquidity to generating steady income or offering diversification benefits.

Ultimately, the best strategy is one that aligns with your goals, time horizon, and risk tolerance. It’s not about finding a foolproof shield against every market drop but about constructing a well-rounded, flexible plan that helps you stay focused on your financial objectives, regardless of the latest headlines. If you’re nervous about market turbulence, use the button below to schedule a complimentary call with our team.