Ready to get ahead financially' Good! Because we’re excited to share some straightforward, no-nonsense advice that may make all the difference in your financial future. Whether you’re just starting or you’re looking to take your money game to the next level, these tips are for you.

1) Pass The Pop-Quiz On Your Financial Situation

Embarking on the journey of financial awareness begins with one crucial step: actually knowing what your money is doing, right down to the penny. Seriously, if you were given a pop quiz on your financial situation, would you pass it' Or would you flunk by getting all the answers wrong'

This step is about gathering data, not making decisions. In addition to building your own balance sheet (assets and liabilities); you should also know things like how much you save, your annual pay from all sources, are your contributions Roth or Pre-tax, your tax bracket and effective tax rate, how much risk each of your accounts take, how much life insurance you have on yourself, etc.

And of course, what happens to your take-home pay. You’re not judging your spending habits or labeling them as financial “rights” or “wrongs.” If you start scolding yourself or feeling guilty it can make the process wwaaayyy more difficult than necessary.

You’re only gaining clarity on where you stand and what your money is doing.

This clarity is empowering. It’s the most foundational step in mastering your finances, and it sets the stage for informed, conscious decisions going forward. Understanding your true financial situation helps you gain knowledge that’s often linked to financial success. People who don’t know their financial standing and don’t learn and follow best practices usually aren’t as successful as those who do. Furthermore, by looking at how you’re paying your bills and allocating your funds, you can design a spending plan you’ll actually follow.

2) Develop A Spending Plan You’ll Actually Follow

Shaking off the notion that a spending plan is a financial dictator is your first step to financial freedom. It’s not about restrictions! It’s about leveraging a tool that liberates you from the shackles of uncertainty, shame, and anxiety. When you know you’re prepared financially, you’ll feel aligned when you spend money.

A practical spending plan always prioritizes the non-negotiables. We’re talking about things like living expenses, insurance, retirement savings, and college funds. Establishing these priorities ensures that your basic needs and future goals aren’t jeopardized.

A great way to manage a spending plan is by following the 80/20 rule. This means you use 80% of your monthly income for both fixed and discretionary household spending. Out of this, spend up to 50% (or less) on “fixed” costs like your house payment and utilities. The other 30% can be used for things you regularly buy like food, gas, eating out, or entertainment.

If your fixed costs are low, you can spend more on fun activities. However, the last 20% of your income should be used to save money for future needs, like holiday presents, vacations, or a new car. By saving 20% of your income, you can build a safety fund and avoid getting into debt with credit cards. This is helpful even in months when you spend more than usual.

A budget that’s all work and no play is a recipe for resentment. Don’t strip away the joy! Balance is key. Make allowances for the things that bring you happiness. If a budget doesn’t respect your downtime, you won’t stick with it.

Please Note: What if your spending plan doesn’t cover your monthly expenses and ideal lifestyle' While it can be daunting to confront these truths, remember, the false comfort of ignorance is a silent saboteur. Embracing this challenge is one of the first real steps toward financial stability and success. You don’t have to create the right spending plan on your own. Use the button below, and we can help you create one from scratch or refine the one you have in place.

3) Expect Financial Storms and Oddball Expenses

Life’s a journey, and along the way, expect a few financial bumps – it’s not a matter of if, but when. From minor hiccups like a flat tire to major upheavals like a sudden job loss, these events can throw a wrench in your financial plans if you’re not ready.

Planning for the worst isn’t pessimistic, it’s proactive.

You can incorporate unexpected expenses into your budget by having something like a “miscellaneous” category. By allotting a couple hundred bucks, you won’t be caught off guard by smaller bumps like an extra trip (or two) to the grocery store.

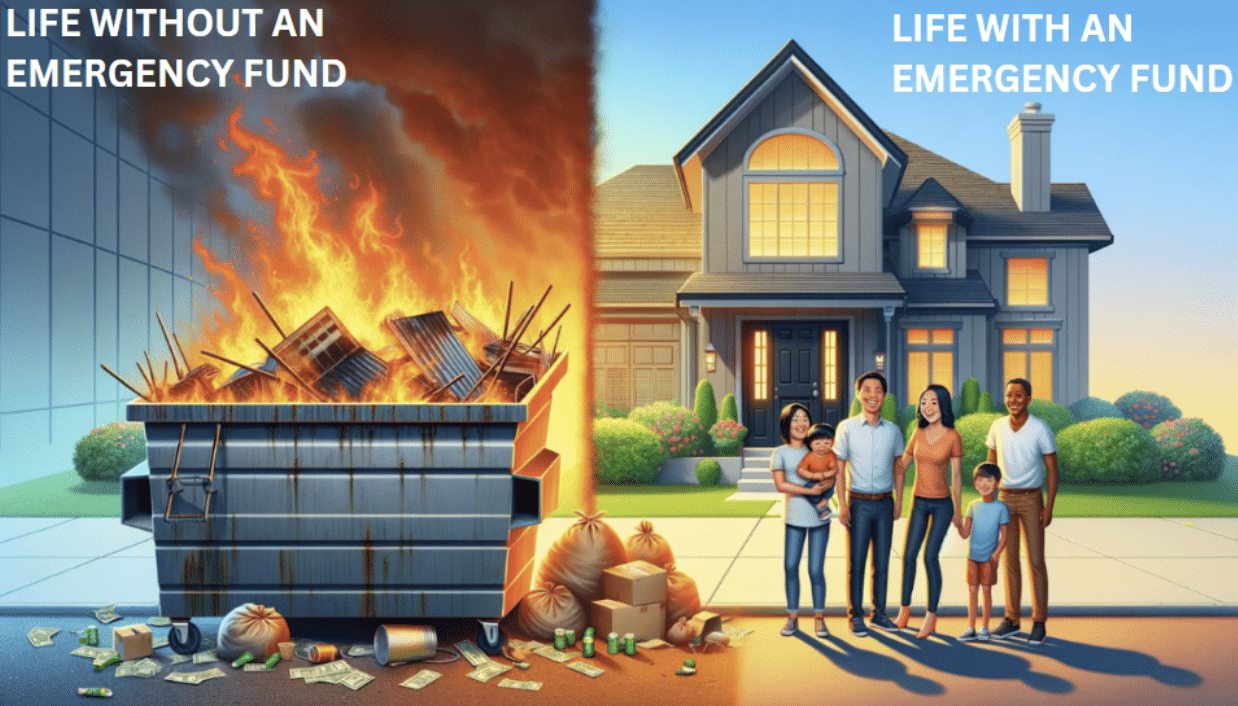

However, to cover life’s bigger financial storms (major home repair), you’ll need a fully funded emergency fund. If you don’t have one already (or if it isn’t ample enough) you can start budgeting to build one up.

4) Don’t Skimp On Your Emergency Fund

Regarding your financial safety net, your emergency fund isn’t just a nice-to-have, it’s a must-have. It’s there to soften the blow of life’s unexpected turns. The general, time-bound rule of thumb' Aim to save up to 3 to 6 months’ worth of living expenses (you’ll get this figure from your budget).

While a smaller emergency fund can let you channel more cash into investments, a more substantial emergency fund offers more immediate security. There is no “perfect” size, it largely comes down to your personal risk tolerance.

Now, where should you keep this fund'

Liquidity is key! Your emergency fund should be in a place where you can get to it fast and without penalty (you DO NOT want to have to take money out of your retirement account(s). Something like a high-yield savings account can strike the perfect balance between earning interest and being readily available when you need it.

5) Cut The Financial Fat

You can find room in your budget by showing yourself some tough financial love and trimming back expenses. The average American can often find budgetary slack in unexpected places. Here’s a deeper dive into where you might find some savings:

Cable TV Packages: With streaming options, do you need all those channels'

Rarely-Used Subscriptions: Streaming services, magazines, or app subscriptions that just gather digital dust.

Excessive Eating Out: It’s not just about fancy dinners; those quick take-outs add up too.

Daily Coffee Runs: Brewing at home could save a surprising amount each month.

High-End Brands: Opt for quality, but question if premium brands are worth the extra cost.

Frequent Online Shopping: Ease off the convenience of constant online buys.

Remember, it’s about getting rid of things that don’t justify their place in your life. It’s about making conscious decisions that support your overarching financial goals.

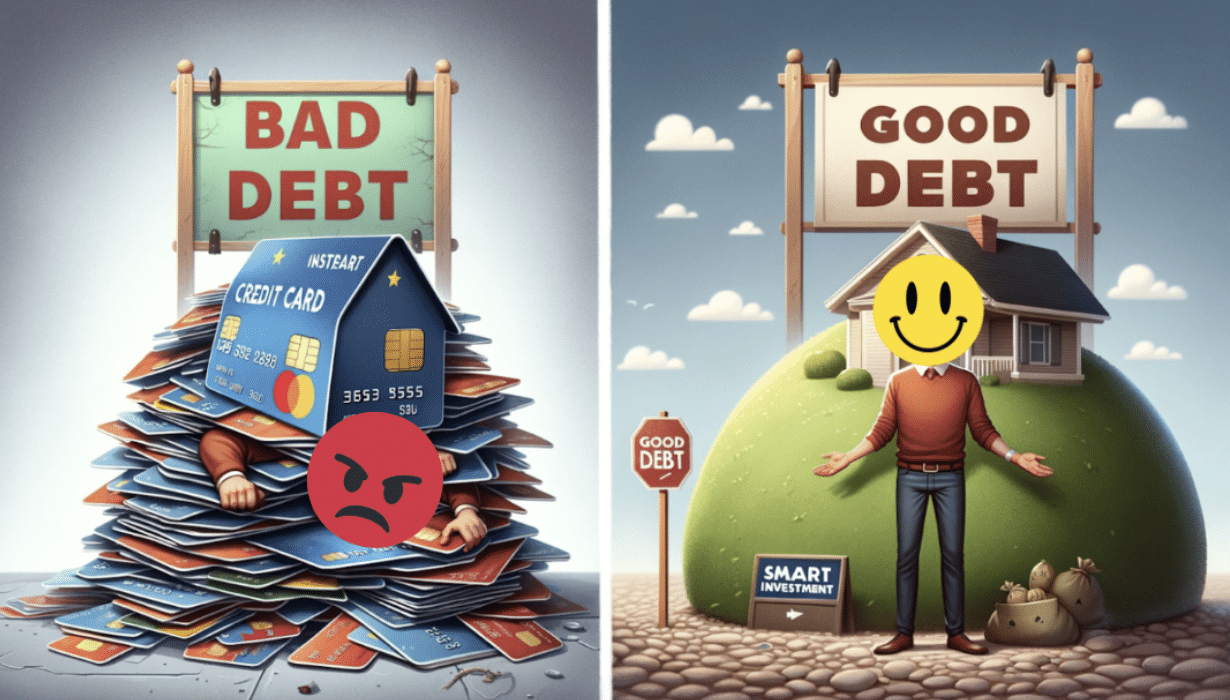

6) Pay Off Bad Debt ASAP

When it comes to getting ahead financially, one of the smartest moves you can make is to tackle “bad” debt head-on. You know the culprits: high-interest debts like those from your credit card or a car loan. They’re like anchors, dragging down your financial progress. So, let’s talk about cutting those chains with a strategy for paying down debt.

First, understand what separates a “good” from a “bad” debt. Good debt can support the well-being of your future self, like a mortgage or student loan with reasonable interest rates. Bad debt' It’s the high-interest, consumer kind that doesn’t offer you any long-term benefits – think credit card balances and high-interest personal loans.

Start by listing down all your debts, prioritizing those with higher interest rates. These are your targets. The plan' Pay more than the minimum each month. Even a little extra can significantly shorten the lifespan of your debt.

Consider tactics like debt snowballing – paying off smaller debts first for quick wins – or debt avalanching, where you focus on the debts with the highest interest rates. Both strategies have their merits; the point is to choose one that aligns with your financial habits and goals.

7) Make The Most Of Employment Benefits

When it comes to boosting your financial health, don’t overlook your employment benefits. These perks, often sitting quietly in the background of your job offer, can play a vital role in your overall financial strategy. Making the most of these benefits isn’t just about taking what’s given; it’s about actively understanding and utilizing them to your advantage.

Dive into what your employer offers. This goes beyond the basic salary – think health insurance, retirement plans, stock options, and even education reimbursements. Each of these can contribute significantly to your financial well-being. For instance, if your employer offers a 401(k) match, match up to the highest amount – this really is free money towards your retirement.

Please Note: Many people aren’t aware that they can get help making the right employment benefit decisions with a financial advisor. An advisor can provide clarity on how each benefit can be optimized as part of your broader financial plan. If you feel overwhelmed or unsure about your employment benefits, consider scheduling a discovery call using the button below.

8) Make Saving A Habit

When it comes to getting ahead financially, one of the most effective strategies is prioritizing saving and investing for your future. Think of it as making regular payments to your future self, ensuring that you’re set for the long haul.

Here’s the deal: before you pay your bills, buy groceries, or even think about splurging on that new gadget, set aside a portion of your income for saving and investing. This isn’t about hoarding every penny; it’s about striking a balance that allows you to enjoy today while securing tomorrow.

Why is this so vital' Because it’s about building wealth over the long term. Whether it’s contributing to your retirement plan, investing in stocks, or simply building up your emergency fund. The earlier you start, the more you benefit from compound interest’s wonderful effects.

9) Boost Your Income

When it comes to advancing financially, one of your greatest allies is your income. It’s more than just a paycheck; it’s a powerful tool for creating wealth. Increasing your earnings can accelerate your journey toward financial goals, whether it’s paying off debt, saving more, or investing for the future. Let’s dive into how both employees and business owners can turbocharge their income streams.

For Employees

Negotiating a Raise: Know your worth. Gather evidence of your value within the organization and market salary data. Approach your employer with confidence and a clear case for why you deserve a raise.

Entering a Sales Role: Sales positions often offer commission-based earnings, providing an opportunity to significantly boost your income based on performance.

Taking on Overtime: If available, overtime work can be a straightforward way to increase your earnings.

Upskilling for Promotion: Investing in your skills can open doors to higher-paying positions within your organization.

For Business Owners

Expanding Services or Products: Diversify what you offer to tap into new markets or customer needs.

Optimizing Pricing Strategies: Review and adjust your pricing to ensure you’re maximizing profits without losing customers.

For Both

Freelancing or Side Gigs: Use your skills to bring in some supplemental income outside of your primary job or business.

Investing Wisely: Whether it’s stocks, real estate, or mutual funds, investing can power your wealth’s growth over time.

Exploring Passive Income Streams: Look into income sources that require less ongoing effort, like rental properties or investments.

Educational Advancement: Enhancing your qualifications can open up higher-paying opportunities.

10) Get An Accountability Buddy

Staying on track with your financial goals can be tough, especially when going it alone. That’s where an accountability buddy comes in – someone to keep you focused, motivated, and, most importantly, accountable. Think of them as your financial co-pilot, helping you navigate the ups and downs of your financial journey. Who can be your financial accountability buddy' Let’s look at some options:

Family Members: A sibling, parent, or spouse who understands your goals and can provide support and encouragement.

Trusted Friends: Someone who’s reliable and financially savvy. They can offer a fresh perspective and keep you motivated.

Work Colleagues: They understand your work-related financial opportunities and challenges and can offer insight based on similar experiences.

Personal Finance Groups: Joining a group focused on financial wellness can provide a sense of community and shared learning. There are several online communities where people discuss strategies, share their experiences, and offer support.

Financial Advisors: The ultimate accountability partner. They offer professional guidance, and tailored advice, and can help you stay the course.

Let Us Help You Get Ahead Financially

At Crafted Finance, we get it. Sorting out your finances can feel like an unsolvable puzzle. It’s tough figuring out where to start and what to do first. But, here’s the thing – getting your financial plan rolling can be pretty exciting, especially when you’ve got the right people in your corner.

We’re here to make the whole money thing less of a headache and more of a high-five moment. Whether it’s saving up for that dream vacation, planning for retirement, or just getting your budget in shape, we’ve got your back.

We believe in making financial plans that actually fit your life. No fancy jargon or complicated strategies – just straightforward, honest advice that makes sense for you. And the best part' Once you start seeing your money grow and your goals getting closer, you’ll start to feel momentum behind your financial future.

So, if you’re ready to give your finances a boost and have some fun doing it, we’re ready to help. No pressure, no stress – just you and us, figuring it out together. Want to get ahead with your money' Click the button below and let’s chat. Let’s make your financial goals happen, one step at a time.