Regarding retirement, most people focus on how much they’ve saved. That’s important — but there’s another factor just as important: the sequence of returns. This year, I’ve been having a lot of nervous conversations with clients who are close to, in the process of, or already in retirement.

Despite the stock market starting the year off pretty rocky, this has not been a “down” year in stocks or bonds (at least as of today). But that is kind of like telling the theme park patrons after they get off the roller coaster (in the same place they got on) that the ride was meaningless.

Because hardly anyone gets off the roller coaster and believes they only traveled a few feet…

I’ve been drumming up analogies left and right this year in these conversations, which is what the experts in effective communication recommend. This is because reciting facts, figures, data, and raw numbers often doesn’t make you more comfortable. Our brain’s amygdala convinces us to ignore facts, and instead, we find ways to convince ourselves that facts are distracting from the plane crash that is about to happen.

But after I tell folks about roller coasters and airplane rides in an attempt to empathize, we then have to have real conversations about how the market could be harmful. And if there is one concept that I fear most when I am advising on Retirement Income Planning… it is “sequence of return risk.”

What is the Sequence of Returns?

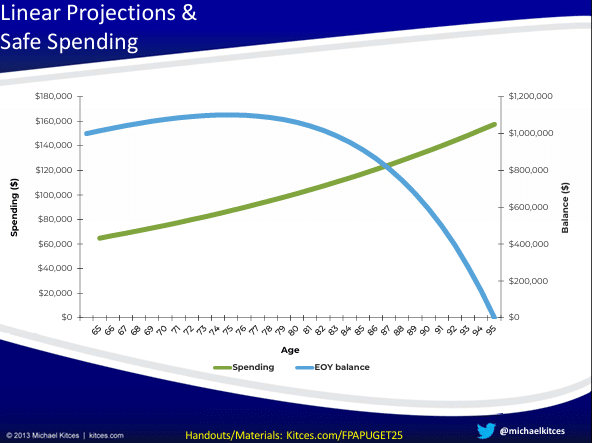

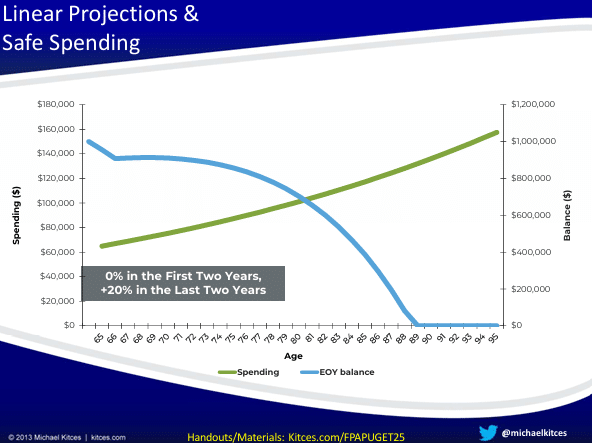

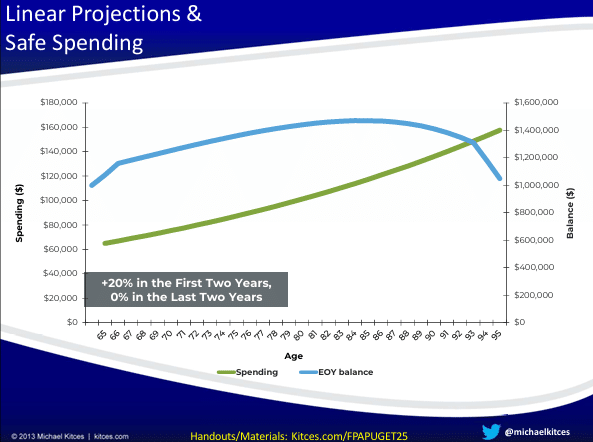

The order in which you earn investment returns, especially during the withdrawal phase of retirement.

Imagine this:

- You retire with $1 million

- You withdraw $50,000/year

- If the market drops early in your retirement, your savings may not last, even if the average return over 20 years is solid.

“Losses early in retirement hit harder – because you’re withdrawing, not just waiting.”

Timing in Investing is Not Everything, But Timing of Withdrawals is Everything

Why Pre-Retirees and Early Retirees Should Care

When you’re working, market downturns are buying opportunities. In retirement, downturns are opportunities to sell investments when they are at their lowest. That’s what makes this concept so powerful (and dangerous if ignored).

“The market always bounces back – but your portfolio might not if you’re pulling money out during the fall.”

How to Protect Yourself

- Diversify Smartly – You need results that mix growth and stability

- Cash Buffer – 1 to 3 years of living expenses

- Flexible Spending – Reduce withdrawals in down years

- Delay Retirement (if possible) – Give your savings more time

- Work with a Planner – Create a withdrawal strategy tailored to you

“A good plan helps you stay retired, not just get there.”

The Hidden Danger Zone: The “Income Gap” Years

Many Retirees plan to delay Social Security or pension benefits to boost their lifetime income, which is smart. But here’s the catch:

The years between retirement and when those income streams begin are the most financially vulnerable.

Why? Because you’re:

- No longer earning a paycheck

- Not yet receiving guaranteed income (like Social Security or a pension)

- Fully relying on your portfolio for withdrawals

- Possibly living a really long time

If the market drops during this “income gap window”, you may be forced to sell investments at a loss to fund living expenses, locking in those losses and shrinking your nest egg.

Punchline: “The riskiest years of retirement are often the first — after the paycheck ends but before the income begins.”

How to Navigate the Income Gap Safely

- Bridge with Cash or Bonds: Hold 1–3 years of expenses in safe assets so you don’t touch stocks in a downturn.

- Guarantees: Sometimes the case for using insurance during these years (e.g., annuities) is compelling. Work with an advisor on this one.

- Consider Partial Retirement: Earning even a small income can reduce portfolio pressure.

- Coordinate Timing: Align withdrawals, Roth conversions, and benefit starts with market conditions.

Punchline: “Bridging the income gap with smart planning is like laying planks over a financial tightrope.”

The Bottom Line

You’ve worked hard to save for retirement. Don’t let a poorly timed market dip derail decades of effort. Understanding the sequence of returns can help you retire with confidence, not fear.

Worried about retiring into a downturn?

Let’s see how your plan stacks up. Schedule a free review and protect your future.