The most argued about topic for couples is money. Another topic of consternation is mixed organizational practices. A good way to solidify a relationship of two people's finances is to be on the same track; mentally and physically. So, take it slow. Like riding a bike, it feels scary and unnatural at first. Here are a few ways to come to a middle ground about finances and after practice and support, it will feel just like well, riding a bike.

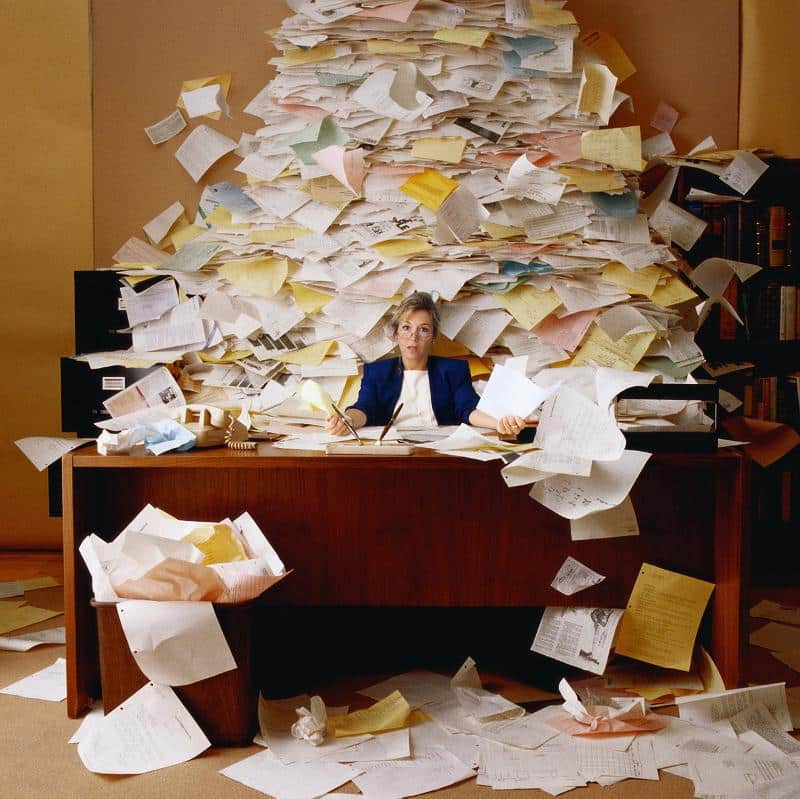

Step 1: Start with piles

To be specific, make 'purge piles.' Make piles of each type of your financial information.

- Investment account statements, monthly and annual

- Tax statements and tax returns

- Loan statements

- Big-ticket item receipts

- Insurance policy statements

- Other (marriage license, wills, deeds)

Go through all paper that is replaceable ie. everything that does not follow into the 'other' category and you are already on your way to a less cluttered and financially stressful life with a system set for future papers.

Step 2: Go paperless

It's really simple and it's really good for the environment and you. Go online to all of your financial accounts and set statements to an online option. Not to mention, it's a good way to have a look at your current positions and evaluate if they are where you want to be.

Step 3: Consolidate

Try any of these and your life will be a little bit simpler. It's an easy way to feel more secure about your future without too much effort. Try the following:

- Drop a credit card

- Update beneficiaries

- Gather all car/home/insurance quotes

- Check credit score(s)

- Check bills for unneeded subscription fees

Step 4: Communicate

It's a hard step but a necessary one. Have an honest conversation about what steps you have taken to be financially where you are now and what is realistically expected in the relationship. Tell each other the story of your money. Discuss your ideal plan for the future and usually that can lead to a'

Step 5: Budget Reset

If you don't know where to start, the '50/30/20' is reliable, however it may need to be adjusted to fit your needs and lifestyle (lots of loans, kids, etc.) Income will be split three ways (50%) Living (i.e. bills that are the same every month), (30%) Spending (i.e. the costs that change based on your behaviors: clothes, eating out, groceries, etc.) and (20%) Saving for financial goals (investments, debt-reduction). With this in place, you and your significant other can start healthfully planning for a successful future.